Asia Palm Oil Magazine Interview with Tan Sri Datuk Dr. Yusof Basiron

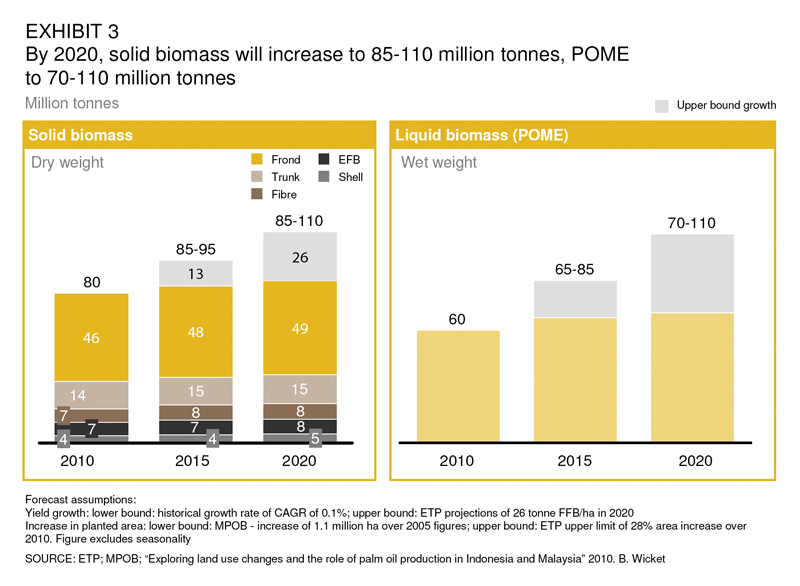

Palm biomass has massive potential. The National Biomass Strategy 2020: New Wealth Creation for Malaysia’s Palm Oil Industry report indicates that Malaysian palm oil industry generated an estimated 80mil dry tonnes of palm biomass in 2010 and this would increase to 110mil dry tonnes by 2020.

Share with us a bit about yourself as the CEO of MPOC?

I joined MPOC in Jan 2006 as Chief Executive Officer. Prior to that, I was the Director General of Malaysian Palm Oil Board for 14 years where I was actively involved in palm oil research.

I joined MPOC in Jan 2006 as Chief Executive Officer. Prior to that, I was the Director General of Malaysian Palm Oil Board for 14 years where I was actively involved in palm oil research.

Briefly describe the history and profile of MPOC?

MPOC is a non-profit organization under the Ministry of Plantation Industries & Commodities Malaysia. It was formerly known as Malaysian Palm Oil Promotion Council (MPOPC) and was incorporated on January 25th 1990 to assume the responsibilities and activities previously undertaken by the Palm Oil Promotion Fund (POPF) Committee. One of the main reasons leading to the establishment of this organization was to address the ‘anti-tropical oils’ campaign in the USA during 1980s. By having MPOPC, we were able to formulate activities in a more systematic way to highlight the health attributes of palm oil to our consumers around the globe. The MPOC name was changed to Malaysian Palm Oil Council (MPOC) on April 13th 2006 to reflect our wider scope of responsibilities such as branding of Malaysian palm oil.

What is the vision and mission of MPOC?

MPOC’s vision is to make Malaysian palm oil the leading vegetable oil in the global oils & fats markets. Our mission is therefore to expand the markets of Malaysian palm oil and its products by undertaking rigorous promotional activities to highlight the techno-economic attributes and sustainability of Malaysian palm oil as well as increase awareness about our products for better acceptance worldwide.

What has MPOC contributed in order to achieve the vision and mission as mentioned above? What role does it play in the Malaysia palm oil industry?

We have promoted the intake and use of Malaysian palm oil and its products throughout the world, either through a series of trade shows such as the Palm Oil Trade Fair & Seminar (POTS) which we carry out in major markets. Buyer- seller missions are organised during this event to ensure we find new markets for palm oil. In conjunction with POTS, we now also carry out consumer programmes that help to better inform consumers on the health and nutrition benefits of palm oil as they are the end users. We actively use new platforms such as the internet and social media by organising internet- based seminars for the trade. In addition, we have programmes in place to help Malaysian companies to penetrate markets by launching new products. We are also in direct contact with the Ministry to provide our views on policy matters and also tackle issues to ensure fair trade.

Any notable challenges that MPOC has faced so far in order to develop the palm oil industry in Malaysia?

I would say branding of Malaysian palm oil remains our main challenge. It is a new area that needs to be explored to take the industry to a new level to give us a competitive edge in the global oils & fats market. Moving forward, sustainability issues will be advanced through the Malaysian Sustainable Palm Oil (MSPO) certification scheme. This will allow big and small players to be certified sustainable. For example, today we are the first and only vegetable oil in the world to have been certified sustainable under the Roundtable on Sustainable Palm Oil (RSPO) scheme. The industry is aware of the importance of maintaining biodiversity and carrying out conservation efforts and this has resulted in the establishment of the Malaysian Palm Oil Wildlife Conservation Fund (MPOWCF) which is managed by MPOC. RM20 million has been allocated to support wildlife conservation and research efforts.

Can you explain the relevance of the CPO export tax?

The CPO export tax is only applicable when the current price of CPO surpasses the minimum threshold price of RM2,250 per tonne (for CPO exports to be taxed). Then a certain percentage between 4.5% – 8.5% will be imposed on the prices as export tax, which will be collected as government revenue. Logically, the higher the market price of CPO the higher the tax percentage. The CPO export tax is a mechanism to increase the competitiveness of our refining industry so that they would have ample supply of CPO for their downstream products and healthy margins. It could also help keep our national CPO stock at a desirable level (between 1.3mil – 1.5mil tonnes) especially when the prices are low, which means more CPO can be exported without tax.

As we know palm oil is one of the major contributors to the biomass industry. Over the years, the Malaysian government has set policies to promote renewable energy and sustainable process. However, there are some notable challenges that have been faced by the industry players. Based on the issues below, what are your suggestions to overcome the challenges?

Difficulty in getting feedstock from major producers as the ownership of biomass produced from plantations is in private hands, government cannot control whether they want to dispose the biomass or not. In fact, this certainly affects development of the biomass power plant. In order to get enough financial support, they will have to propose to banker and need to present field supply agreement on long term basis, which is impossible to do so. Thus, some industry players are facing financial problems.

The National Innovation Agency Malaysia (AIM) in its National Biomass Strategy 2010: New Wealth Creation for Malaysia’s Palm Oil Industry report has proposed a few measures where the country can utilize its palm biomass for additional RM30bil GNI by 2020. This includes the creation of cooperatives among the plantation owners which would make it easier for downstream companies to source their biomass at a reasonable price.

Meanwhile, difficulty in obtaining feedstock from some major producers might be due to the price offered by entrepreneurs to suppliers. Some entrepreneurs wish to get raw material at a low price to gain profit. However, price should be established at fair and equitable level, where buyers are advised to offer a more favourable purchasing price in order to get a consistent supply. Besides, market forces could be an additional factor as well, where current market forces are not yet able to stimulate biomass for commercialisation.

Compared to foreign conversion technology, some of the local conversion technology, which is available in local universities, still remains at lab skill level, whereas foreigners manage to commercialize their technology up to industrial skill production. There is a gap between lab skill technology and industrial skill production. Meanwhile, not many entrepreneurs are fully confident to invest in the local technology to commercialize it.

The MPOB organizes Transfer of Technology seminars on a yearly basis where various technologies including those associated with palm biomass utilization developed by their scientists are presented for commercial use. There are a number of MPOB technologies that have been successfully converted to industrial scale such as palm wood technology and palm pellets. Basically, it is up to companies to work with MPOB to commercialize these technologies. Alternatively, companies can also work with local universities to invest in new technologies or obtain licence to commercialize their technologies. They may also consider bringing in foreign technologies to utilize our palm biomass.

Investment is the ability to take risk; it doesn’t matter if it is local or foreign technology. The important factor is how a project can make a profit.

As the CEO of MPOC, do you have any advice to the Malaysia palm oil industry players?

Palm biomass has massive potential. The National Biomass Strategy 2020: New Wealth Creation for Malaysia’s Palm Oil Industry report indicates that Malaysian palm oil industry generated an estimated 80mil dry tonnes of palm biomass in 2010 and this would increase to 110mil dry tonnes by 2020. The report also shows that by utilizing additional 20mil tonnes of palm biomass by 2020 for higher-value downstream products, the country would benefit from RM30bil additional GNI and creation of about 66,000 new employment opportunities. Therefore, I would advise the industry players to concentrate on utilising palm biomass to diversify their products. Currently, there may be a lack of awareness, thus more marketing efforts are needed. In addition, we need to create more efficiency by reducing operating cost and meeting customers’ requirements or expectations.

There is research indicating that soy bean is considered as a major threat to palm oil. Does it affect the palm oil industry in Malaysia?

Palm oil is a major vegetable oil in the oils and fats supply chain. Therefore it remains a strong competitor to all oils as it can easily replace them in many applications. We all need to compete to gain market share but that should not be at the expense of other oils. We promote palm oil on the basis of its strength such as its trans- free application that is widely accepted by the industry.

With the world requiring double the amount of commodities including oils and fats by 2050, Malaysia will continue to take centre stage in the international supply chain. Other sources of edible oils will not be able to expand as easily as they are land intensive. The responsibility will fall on palm oil, which is land efficient. Many countries use extensive portions of land in order to maintain its growth rate while Malaysia can do the same thing by only using 24 percent of its land for agriculture.

Leave a Reply